Which are the 5 Cs regarding borrowing?

Lượt xem:

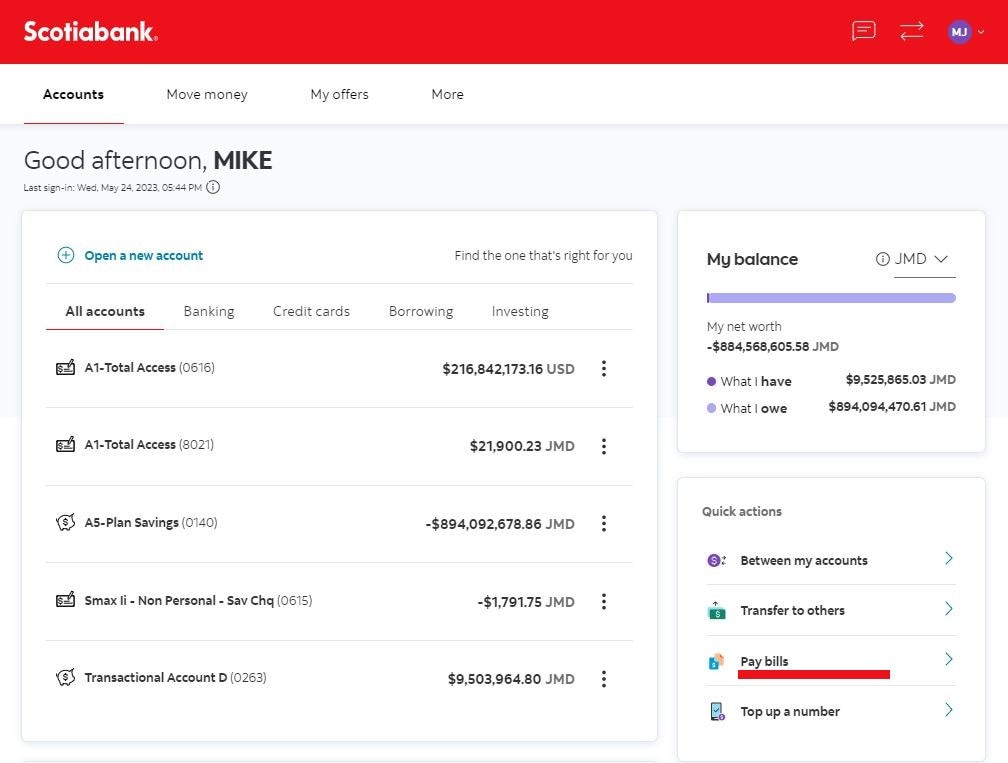

cuatro. Equity

Equity can help a debtor safer loans. It gives the lending company the latest guarantee that when the brand new debtor non-payments towards loan, the lender could possibly get one thing right back from the repossessing the fresh guarantee. The newest security is usually the object in which you’re borrowing from the bank the cash: Automotive loans, including, are shielded by trucks, and you will mortgages was shielded of the house.

Therefore, collateral-recognized money are often known as secured finance or shielded debt. They are usually reported to be less risky to own lenders in order to thing. This is why, financing that will be protected by some form of equity are generally incorporated with down rates and higher terminology compared to other unsecured types of money.

Boosting your 5 Cs: Security

It is possible to alter your guarantee by just entering into a certain form of loan arrangement. A lender will often lay a lien for the specific form of property with the intention that they have the legal right to get well loss in the event of your default. It security contract are an importance of the loan.

Other particular loans ple, personal, unsecured loans may require placing your car or truck because the guarantee. For these variety of fund, be sure you has assets that you can article, and remember that the lender is just eligible to such property for individuals who default.

5. Requirements

Also exploring income, lenders go through the standard conditions concerning the mortgage. This may are the length of time that a candidate enjoys been working at the current job, exactly how its industry is undertaking, and you may upcoming work stability.

New conditions of your financing, such as the interest plus the level of prominent, influence new lender’s want to money the borrower. Conditions is also refer to how a borrower plans to use the money. Business loans that will give coming income possess top criteria than simply a property restoration throughout a beneficial slumping houses ecosystem when you look at the which the borrower does not have any aim of attempting to sell.

Concurrently, loan providers get think criteria beyond your borrower’s control, like the county of your economy, industry fashion, otherwise pending legislative alter. Getting people trying secure a loan, these types of unmanageable conditions may be the candidates from key service providers or consumer monetary defense on coming many years.

Some think about the conditions you to definitely lenders have fun with as four Cs. Because conditions age from 1 debtor to a higher, frequently it’s excluded to stress the fresh requirements most in charge from a debtor.

Boosting your 5 Cs: Requirements

Requirements are the the very least most likely of your own four Cs as controllable. Of several standards such as for example macroeconomic, all over the world, political, otherwise large monetary facts may well not apply particularly to a borrower. Alternatively, they can be problems that all the consumers could possibly get face.

A borrower may be able to manage particular conditions. Always have an effective, solid cause of incurring loans, and also inform you how your budget supports they. Organizations, such as, may need to demonstrate strong applicants and you can healthy monetary projections loan places Oak Hill.

Exactly why are the 5 Cs important?

Loan providers utilize the five Cs to determine if or not a loan applicant is eligible for borrowing and to determine related interest levels and you may borrowing from the bank restrictions. It let influence this new riskiness out of a borrower or the probability that the loan’s principal and appeal could be paid from inside the a full and you can punctual style.

And therefore of your own 5 Cs is a vital?

Each of the four Cs has its own worthy of, each is highly recommended important. Some lenders could possibly get bring more excess body fat to own classes as opposed to others depending towards prevalent circumstances.

Character and you can capability are usually important to possess determining whether or not an effective lender commonly stretch credit. Banking companies using obligations-to-money (DTI) rates, home income limits, credit rating minimums, or other metrics will usually look at those two classes. Although the measurements of an advance payment otherwise security will help raise financing words, these are perhaps not the primary products in how a beneficial lender decides whether to use credit.

.jpg)