The great benefits of To buy good Foreclosed House

Lượt xem:

Knowing the Property foreclosure Process

Foreclosure generally start when a resident does not build mortgage repayments, best the borrowed funds in order to default. Through the years, in the event the a fantastic repayments commonly compensated, this new lending institution might propose to foreclose on the possessions. This calls for a legal process where in fact the homeowner’s legal rights toward assets was terminated.

If this happens, the property is usually marketed from the an auction, while it generally does not sell here, it may be detailed with real estate professionals. This is how audience can imagine to acquire an effective foreclosed household .

When looking on housing market, foreclosed house was enticing candidates for several causes. They frequently incorporate a lesser cost, giving potential buyers an easily affordable entryway to the homeownership. This could cause instant equity on assets.

Furthermore, into fluctuation away from a house prices, to purchase foreclosures might provide a chance to purchase assets inside nations in which costs enjoys increased beyond the mediocre consumer’s arrive at. Hence, foreclosed residential property establish not just an inexpensive alternative but also an money opportunity for potential enjoy.

Special Considerations When searching for Foreclosed Property

Property Updates: Foreclosed house will often suffer from neglect. Be sure you may be familiar with the condition of the home and you may one expected fixes. A comprehensive evaluation is vital.

Community and Sector Manner: The worth of property is frequently tied to the place. Look into the neighborhood’s assets philosophy, coverage, facilities, and you will potential for upcoming increases.

Pricing against. Value: Cause of the expense of every home improvements otherwise solutions the house need. Either, just what appears to be a bargain could end up costing a lot more during the the near future. Constantly weighing the initial will cost you against the prospective long-term well worth.

Really serious Architectural Points To look at To own

Architectural damage normally undoubtedly impression a beneficial property’s worthy of and safety. Secret signs were obvious base breaks, windows and doors that don’t intimate securely, and holes anywhere between structure and flooring, every demonstrating potential foundation items. Reduce roofs, liquid stains into the, and you may proof of water damage highly recommend potential leakage, when you’re shape development denotes expanded dampness factors. Uneven flooring might idea during the difficulties with underlying supports.

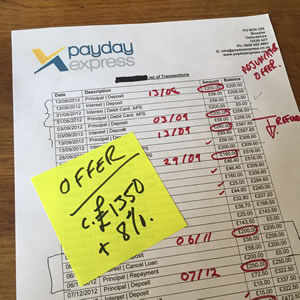

Pest trails or damaged timber code infestations one compromise structural ethics. Outdated plumbing system and you can electric possibilities pose one another pricing and you can safety issues. At exactly the same time, Do-it-yourself repairs of the prior owners payday loans Frisco get hide higher circumstances. Given such complexities, especially in property foreclosure features, a comprehensive household examination is extremely important before purchasing.

Purchasing a foreclosure Which have a keen FHA Loan

Purchasing a foreclosure having fun with an enthusiastic FHA mortgage shall be feasible, albeit with standards to be familiar with. This new Agencies off Houses and Urban Innovation (HUD) takes care of foreclosed qualities which were financed having FHA money. These types of features are next noted on the market for the HUD Family Shop. Audience would be to ensure that the possessions meets FHA’s conditions when offered this package.

Pressures of shopping for a foreclosure Which have an enthusiastic FHA Mortgage

Whenever you are to invest in a foreclosed house or apartment with an FHA financing may seem glamorous, discover built-in challenges. One to concern is this new FHA property status requirements. Any house financed which have an FHA loan must meet certain criteria to be certain it’s safe, safe, and you can structurally sound. If the foreclosed possessions does not see these requirements, one called for fixes should be completed until the mortgage becomes accepted.

Prospective consumers you’ll check out the FHA 203(k) financing to have property in need of good works. That the loan wraps the cost and also the cost of advancements on the an individual financial, enabling repairs or home improvements. But not, this process can be more complex and could incorporate a lengthier closure period.

Additionally, whenever putting in a bid into foreclosed functions, you can face firm race regarding dollars buyers, which suppliers commonly choose because of smaller transaction times. Finally, audience ought not to miss the inspection processes. It’s important to see the actual condition of the property and you may people undetectable costs which could occur of unanticipated fixes.

.jpg)